How to Choose The Right Financial Adviser

Take the time to compare different advisers. Knowing what to expect and what’s in it for them, can make all the difference.

A good financial adviser gets to know you. They work with you to set your lifestyle goals and move these into financial terms. They then work out a plan to help you achieve these lifestyle goals.

To help with this process most financial advisers do not charge for the first meeting. This makes it easier to meet with and compare a few advisers.

We think it’s important that you take the time to find someone who you can trust and who aligns with your vision and values. To do that, we have put today a few tips below to help you in your search for a financial adviser.

1. Make sure your financial adviser has an Australian Financial Services (AFS) Licence or is an authorised representative. You can check this on the Financial Advisers Register: Financial advisers register - Moneysmart.gov.au

This site indicates

> What areas of advice the adviser is licensed to provide.

> What disciplinary actions have been taken against them.

> What qualifications and training they have completed.

> Have they ever failed to meet the Continuing Professional Development (CPD) hours required each year.

> What associations do they belong to.

2. Ask them about their qualifications, main client base, and areas of advice. New Educational requirements are coming into play for advisers in two stages. This is part of FASEA (Financial Advisers Standards and Ethics Authority) established in 2017

a. Stage 1:

By 1 January 2022, all advisers must have passed the FAESA Exam and completed an Ethics Module at University Level to be able to provide advice.

Note: After the January 2021 Exam – only 12,000 (slightly above 50%) of the financial advisers on the register above have passed the exam.

b. Stage 2:

By 1 January 2026, all advisers are required to have completed a FASEA approved Bachelor Degree or above. How are they positioned for this change?

3. Read your adviser’s Financial Services Guide to learn about their fees and services and how they deal with complaints. Do they explain the FSG in the first meeting?

a. Part 1 of the FSG usually deals with the Licensee

b. Part 2 of the FSG usually called the Adviser Profile should outline their Education and Experience.

4. Ask the adviser how they approach determining how much risk you should take. Ask them to quantify the worst-case scenario for you. Ask them how will they manage this risk for you?

5. Ask the adviser for some Testimonials – do they have satisfied customers who are prepared to give feedback

Why should you choose Hell Yes! Financial Advice?

Hell Yes! derives its name because the team believes that financial advice can help change lives. Hell Yes! to Financial Advice to all!

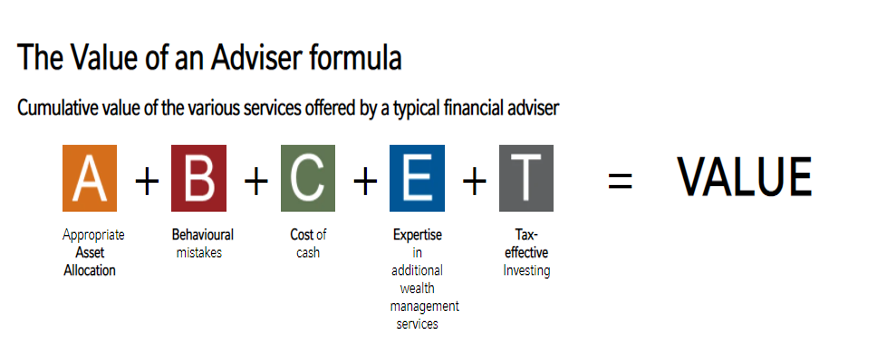

We believe that the value of advice can be quantified in real value to the client each and every year. From the Russell Investments Report collated each year the value of advice is articulated as:

In 2020 Russell Investments stated that this value was 4.4%

If you would like a copy of the most summary, contact our office at admin@hell-yes.com.au.

Our Client Value Proposition is that:

We want to:

a. Know You

b. Know your family

c. Understand what is important about money to you

We aim to give you Peace of Mind that you will achieve your lifestyle and financial goals.

We believe in a Life First Approach – ensuring that you live your best possible life, whilst ensuring you achieve any assistance you would give to your family members

Our Financial Advice will help you to live your best possible life with peace of mind around achieving your goals in the future.

Testimonials:

Vicki O’Connor’s testimonials are collected on a site called Adviser Ratings: https://www.adviserratings.com.au/

Part of the Family...she understands us, our needs & our aspirations; Open, honest & caring; Knows the level of our understanding in relation to all things Financial & matches that with effective communication & advice; A great balancing force with our Accountant in development of our financial strategies; We rate her Top Gun!

Vicki has given us guidance in several areas, including SMSF, Tax planning, transition into retirement and investment strategies. Vicki also suggests profit taking when the time is right, and also the need to ride out the highs and lows of investing in the stock market. If a question is asked by phone or e-mail, a reply is forthcoming in a timely manner. we feel very comfortable in Vicki's advice.

This information is of a general nature only and has been provided without taking account of your objectives, financial situation or needs. Because of this, you should consider whether the information is appropriate considering your particular objectives, financial situation and needs.

Your Advisors are Hell Yes! Financial Advice Pty Ltd, ABN 25 618 086 605 | CAR 1254388

A Corporate Authorised Representative of Viridian Advisory Pty Ltd, ABN 34 605 438 042, Australian Financial Services Licence 476223

Vicki O’Connor AR 1000956, an Authorised Representative of Viridian Advisory.